Will Street

@WillStreet_fx

🐺 DECODING THE ALGORITHM 🥷🏼 Have you ever thought about how the algorithm is coded? I guess you’ve never paid enough attention to the details. I’m going to start a series and reveal a small portion of how price delivery works and how we can take advantage of it. Let's go to CHAPTER 1. A thread🧵

(2/10) For market makers, it's impossible to manually control the prices of all markets, assets, and timeframes. For this reason, in the 80s, an algorithm was invented to deliver prices efficiently in the markets. The market makers only need to input certain values, specify the program in which they want the price to execute the movement, and set the speed.

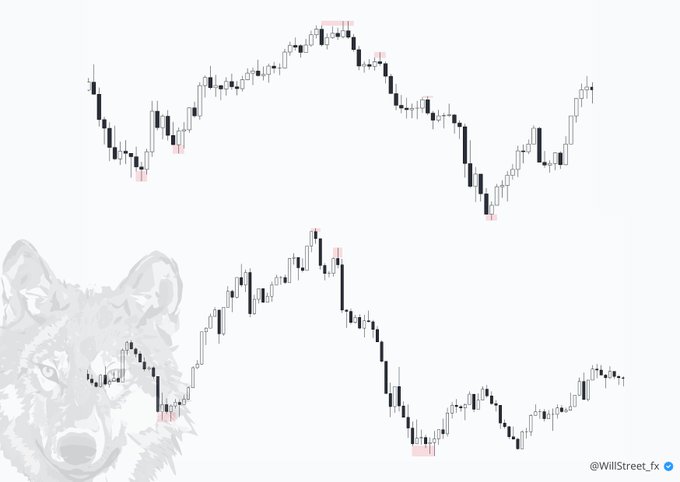

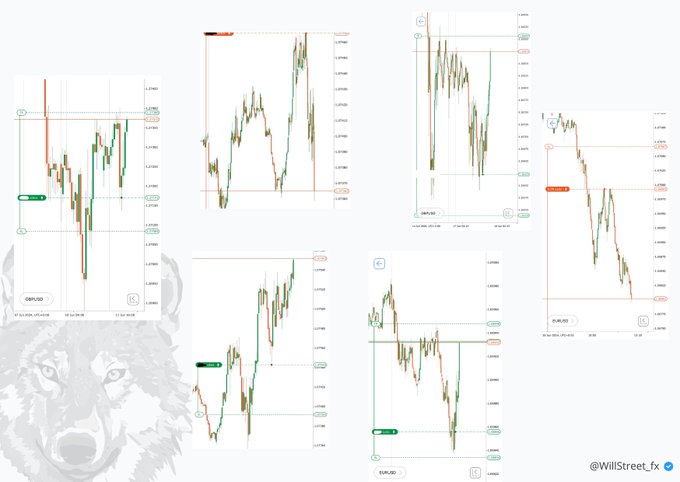

(3/10) Since the algorithm is coded the same way, it makes the price fractal across all timeframes—annual, weekly, and even 15-second charts. The only thing that changes is the time it takes to form the candle.⚡️

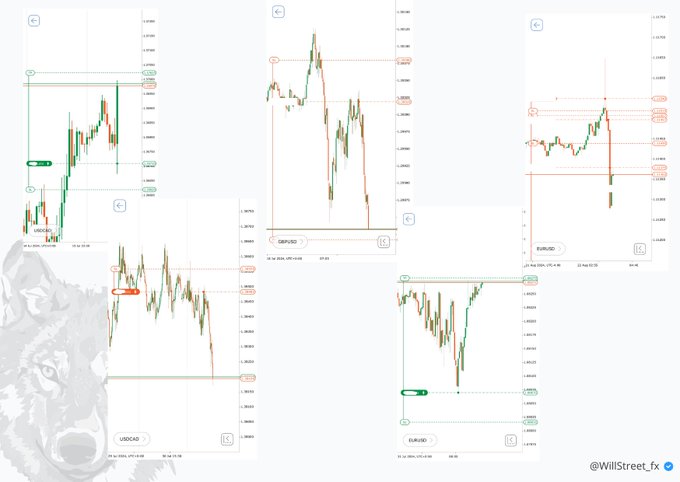

(4/10) In the first chapter, I’ll discuss the efficiency of price delivery. Do you notice any visual differences between the two charts?🪞 And if I tell you that one is a weekly chart while the other is a 1 minute chart, what do we notice in both charts when creating a swing high or low and reversing?

(5/10) Before starting a bearish move, the algorithm will create a new candle that mitigates the last high to enable a downward move. The intention is to reduce the maximum number of people making money while shorting and to hunt for the maximum number of stops from early sellers. The opposite occurs in a bullish market.

(6/10) How can we identify a swing and that the price will reverse? 🥷🏼In this chapter, I won’t reveal this secret. Just think about aspects like time and simple things such as candles, highs, and lows.

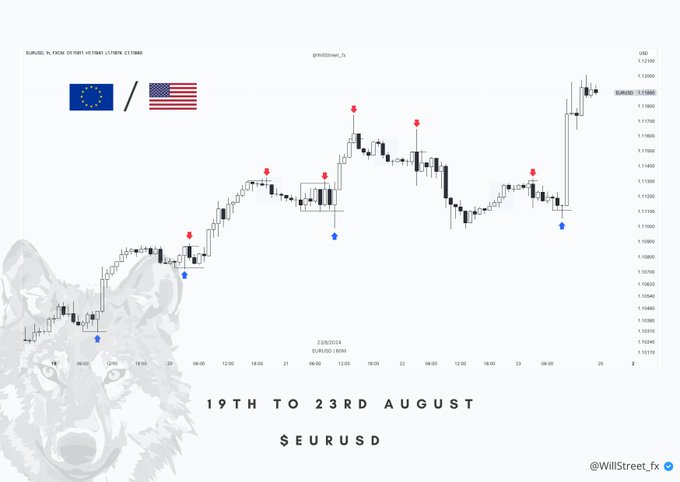

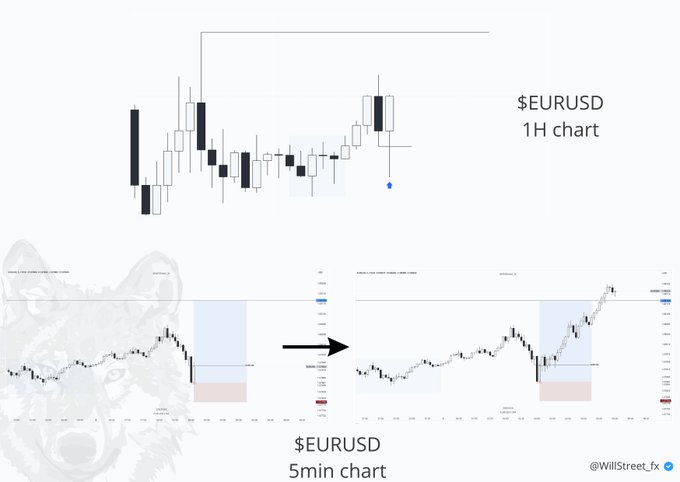

(7/10) As mentioned earlier, this occurs in all timeframes you can imagine. For my trading style, it doesn’t make sense to wait for a monthly or weekly high or low to be mitigated, or for a 1 minute or 15-second candle to be mitigated… But, what if we wait for the 1 day and 1h candle to be mitigated?

(8/10) So, how can we take advantage of this? When a swing high or low is created, we wait for the next new candle that mitigates the opposite side of the next movement and then enter our trade. This is how we can trade turtle soup setups with such precision and capitalize throughout the entire movement.

(9/10) What happens with swings where the previous candle is not mitigated? Then a failure swing occurs. How about 500 retweets for this to be Chapter 2? ;)

(10/10) Closing here... To conclude, we wait for a raid of the previous HTF candle and when it's mitigated we go to LTF and wait for exactly same protocol. If you enjoyed this thread, please share and give some love. Can we reach 500 RTs for Chapter 2? 🥷🏼You won’t want to miss the failure swing... Att, - 🐺