🥷 Welcome to Chapter 3 of the series "DECODING THE ALGORITHM by WillStreet In this chapter, I’ll be talking about: FAILURE SWINGS Why doesn’t the price always take out the previous low or high before making a move? Let’s find out! 🧵👇

(2/14) 🔙Before we begin, you should have watched the previous two chapters to understand the context and how the algorithm is programmed to move the price. If the price always took out the previous candle on every timeframe before each move, it would become too predictable so everyone would make money. 🥷That’s why there are certain conditions and characteristics that trigger exceptions, leading to the Failure Swing.

(3/14) ⏲️In essence, a Failure Swing occurs when the price fails to create a new swing before making a move. However, this isn’t always the case; sometimes, a failure swing can appear mid-move, but always keeping in mind what was discussed in Chapter 2 about the start of the trading hours.

(4/14) 💡Here’s an example of what a Failure Swing looks like visually. In this case, we would keep waiting for the previous high to be taken out, and we’d never get our entry. In Image 2, you can see the ideal entry at 02:00 and the ideal exit at the new low at 05:00.

(5/14) Let’s start with the reasons why this happens: 💎Reason #1: Divergence with highly correlated or inversely correlated pairs (like the DXY). In this example, Pair A does take out the previous HTF candle, while Pair B fails to do so. Therefore, Pair B would be valid for selling because, according to the algorithm, the raid on the previous candle has already been completed, and there’s no need to revisit it.

(6/14) Here’s a real example showing a Failure Swing at the beginning of the move and mid-move. Beginning: The 03:00 candle fails to mitigate the low of 02:00, while the correlated asset (GU) does. In this case, GU is our trigger, and we’re clear to buy. Mid-move: The PO3 of the 04:00 candle in EU fails to mitigate the low of the previous candle, while GU completes it, making it valid for buying as well. Our exit for the long would be at the new 4H or 6H candle, around the new high at 05:00.

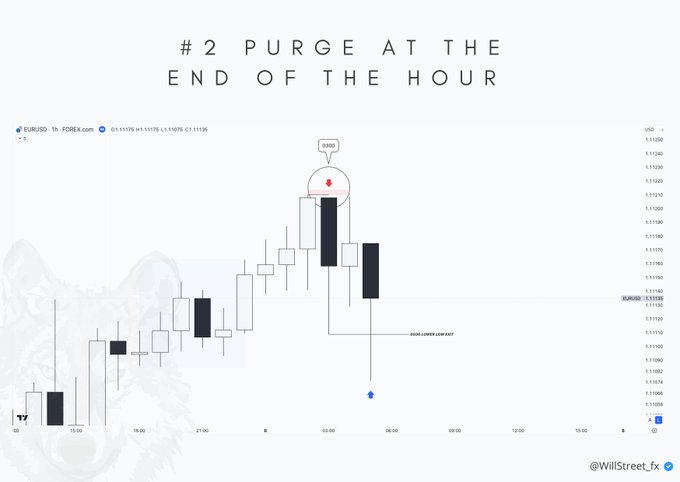

(7/14) 💎Reason #2: Purge at the End of the Hour If the price created a raid on LTF in the last 15 minutes of the hour, the algorithm validates this raid. The new hourly candle will fail to attempt the raid again (since it’s already been done). Our entry would be on the new candle, after the LTF raid, as we need confirmation that it won’t be revisited.

(8/14) Here’s a real example: On the 1H chart, the price fails to create a new high. I imagine it this way on the chart for the following reason: In the 5-minute chart, we see the high occurred exactly at 02:55, the last candle of the 02:00 hour. The algorithm validates this raid, so it doesn’t need to revisit it. The entry is at the 03:05 candle, and the exit is, as usual, at the new candle at 05:00.

(9/14) Another example, same process: The 03:00 candle fails to create a new high. We check the LTF to see what time this occurred, and surprise, it was again at 02:55. Our entry is at the 03:05 candle, and the exit is at the low of 05:00. Here, we also have extra confirmation, GU did take out the high of the 02:00 candle, giving us two confluences that indicate the price is about to start a bearish move.

(10/14) 💎Reason #3: Price Attempts to Make the High or Low at the Beginning of the Hour In the first 15 minutes of the new hourly candle, the price tries to attack the previous high or low and fails. When it fails, the algorithm validates the raid of the previous candle. Adding divergence to this reasoning strengthens the argument.

(11/14) Let’s look at a real example: On the 1H chart, EU fails to create a new high at 08:00. When we look at the 5-minute chart, we see that at the beginning of the hour (08:05), the price attempts to create the new high but fails, this is validated. In this case, GU followed the correct procedure, so we add strength to our argument with divergence.

(12/14) Another example: Now we’re at the London lunch. At the 05:00 candle, the price takes out the high of the 01:00 candle. When we check the LTF, we see that at the start of the new hourly candle at 06:00, the price tries to make a new high, taking out the high of the 05:00 candle but fails. Entry would be on the next candle, after rejecting the high, with our exit at the new 4H candle at 09:00.

(13/14) These are the main reasons but there are others I can't share.🤐 🥷Chapter 4 will focus on the logic behind my entries and exits and how the algorithm seeks efficiency when creating price reversals. For that, 250 RTs, just like in Episode 2! 😉

(14/14) The main reasons why the price fails to mitigate the previous high or low before making a move are: · Divergence with a correlated or inversely correlated pair · The last candle of the hour completes the LTF raid · The first 15 minutes of the new candle attempts to attack the previous candle but fails. 🩷If you found this helpful, I’d appreciate a like + retweet for my work. That way, I’ll continue the series with 🥷Episode 4: The Logic Behind My Entries and Exits. Att: - 🐺