We now know Trump's TOP economic priority: For weeks, President Trump said there would be NO tariff delay, even as stocks erased $12+ TRILLION. Then, the bond market BROKE and a 90-day tariff pause was implemented 12 hours later. Keep watching bonds. (a thread)

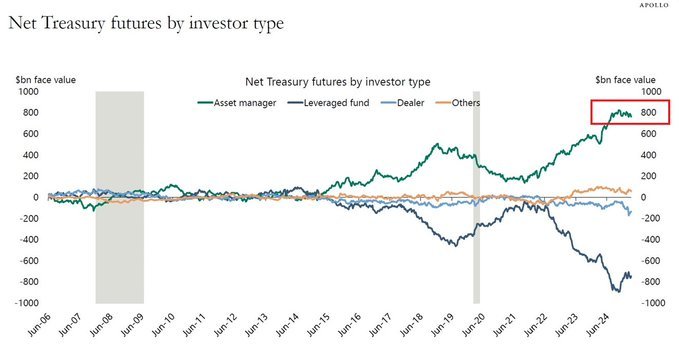

Prior to the April 2nd "reciprocal tariffs," the 10-year note yield was falling in a straight line lower. This meant the trade war could continue because rates were falling. However, as the basis trade unwound due to volatility, the 10-year note yield surged +65 bps to 4.50%.

President Trump has made it clear that LOWER interest rates are one of his top priorities. Even on April 4th, Trump called on Fed Chair Powell to "cut interest rates." The trade war was sending energy prices and interest rates lower. So, Trump could continue the pressure.

However, something changed on April 7th when interest rates began skyrocketing as stocks fell. The divergence between the S&P 500 and 10Y note yield as shown below is historic. Bonds are crashing at an even FASTER rate than stocks, even as they are considered "safe havens."

Then, on April 7th, at 10:15 AM ET, the first headlines of a 90-day tariff pause emerged. The White House proceeded to call this "fake news," but it's clear now that it was not fake news. Trump was likely discussing this 90-day pause with advisors as the 10Y yield surged.

2 days later, the 90-day tariff pause was announced, on April 9th. Then, Trump basically confirmed that the bond market was the reason. "I was watching the bond market. It's very tricky. If you look at it now it's beautiful," he said. This was an interest rate-driven move.

More specifically, at the end of the clip he says "yeah I saw last night where people were getting a little queasy." He was referring to the basis trade unwinding, as outlined 2 posts above. Trump knew the $800B basis trade would send the 10Y to 5% if he did not intervene.

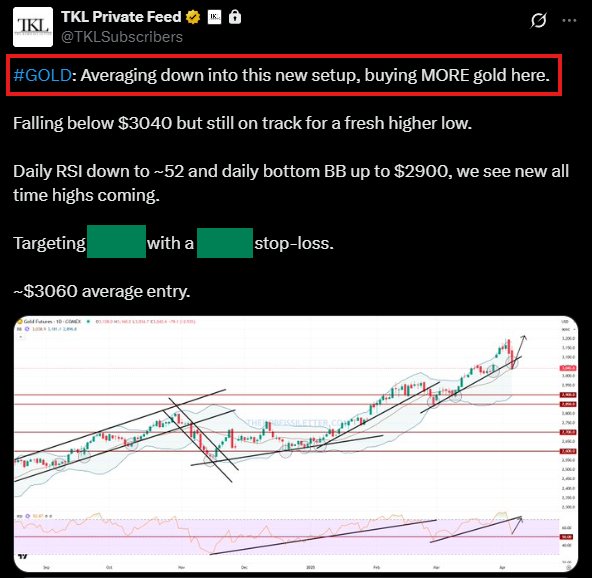

As a result of the basis trade collapsing, safe haven demand has quickly funneled into gold, yet again. Gold prices are now up nearly $200 from the lows seen just days ago. Central banks and foreign investors are buying even more gold as the US Dollar has declined.

Our premium members BOUGHT gold into the weakness this last week. We called for a higher low near $3000 and longs are now up +$90, as shown below. Gold continues to suggest more volatility is ahead. Subscribe to access our premium alerts: http://thekobeissiletter.com/s...

Since the 90-day pause and Trump admitting he is "watching the bond market," here is what has happened to the 10Y. It's now down ~20 bps from the high, but more importantly, not rising. However, it is still well off the lows and will remain a key factor in Trump's decisions.

Unusual times lead to unusual swings in the market, and uncertainty is at March 2020 levels. Our subscribers are capitalizing on these swings. Want to see how we are trading it? Subscribe at the link below to access our latest analysis and alerts: http://thekobeissiletter.com/s...

If you want to know what President Trump's next move may entail, watch the bond market. Sudden moves in the 10-year note yield in either direction will impact policy. A huge takeaway from this week's events. Follow us @KobeissiLetter for real time analysis as this develops.