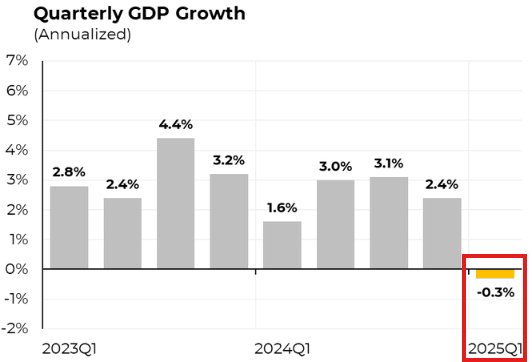

The Fed's worst nightmare just got worse: New data showed that US GDP CONTRATCTED by -0.3% in Q1 2025, while +0.3% growth was expected. To make things worse, the GDP Price Index surged to +3.7%, its highest since August 2023. What does Powell do now? (a thread)

Annualized US GDP growth came in at -0.3% this morning, below expectations of +0.3%. This marks the first negative reading since Q2 2022. Just 4 months ago, GDP was expected to grow by over 3% in Q1 2025. We have seen a MASSIVE shift in US economic output.

Treasury Yields are surging, with the 10Y Note Yield up almost 10 bps from its pre-data release low. Why are rates rising in an economy that is shrinking? The market knows that stagflation has arrived. The Fed is facing the lose-lose situation they thought would never arrive.

And, it gets even worse. Take a look at the PCE Price Index which surged +3.7% in Q1 2025. This is above expectations of 3.1% and up from 2.6% in the previous release. The PCE Price Index is now at its highest reading since July 2024, before the "Fed pivot" began.

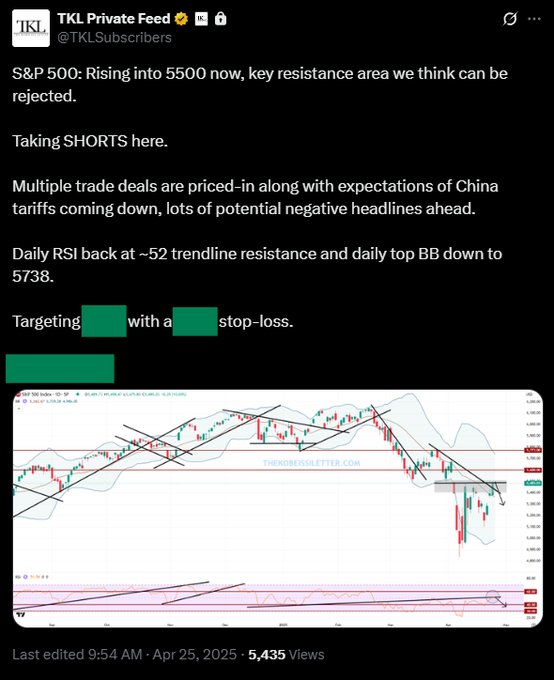

Stocks are falling sharply after the data and we were SHORT going into this week. As posted below for our premium members, we took shorts as the S&P 500 rallied into 5500+. S&P 500 futures now down -1.5%. Subscribe to access these alerts below: http://thekobeissiletter.com/s...

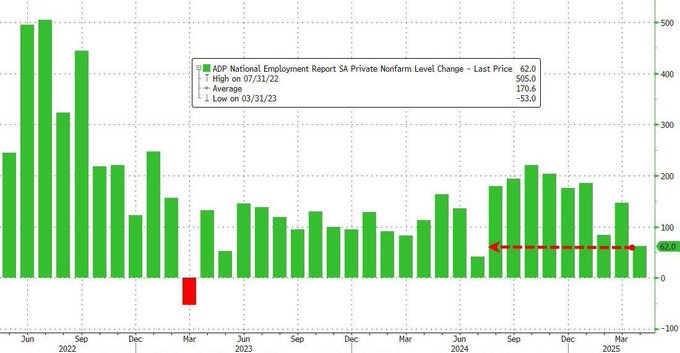

Minutes before the GDP data this morning, ADP Employment data was released. According to ADP, the US economy added just 62,000 jobs in April, the lowest since July 2024, as shown below per ZeroHedge. Yields initially sold off on this data as the economy is clearly weakening.

This also explains recent price action in oil markets. While the S&P 500 and other risky assets rebounded, oil prices have fallen sharply, to below $60.00. Why did this happen? Because oil markets have been pricing-in a recession and decline in demand for months now.

Our premium members took SHORTS in oil as it neared $65.00 earlier this month. These shorts are now up sharply as oil falls into $59.00. Commodities have been clearly pricing-in a recession for months now. Subscribe to access our alerts below: http://thekobeissiletter.com/s...

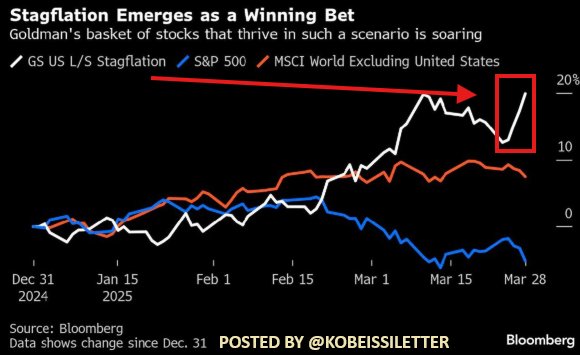

One month ago, we posted that Goldman's basket of stocks that thrive in a "Stagflation Scenario" are soaring. Today, it we received confirmation that stagflation is worsening. We have rising inflation with a weakening economy. The Fed is officially in a lose-lose situation.

Effectively, the Fed must pick between containing either inflation or unemployment. Not reducing interest rates will further weaken US GDP and likely increase unemployment. However, if interest rates are cut immediately, we would expect to see another rebound in inflation.

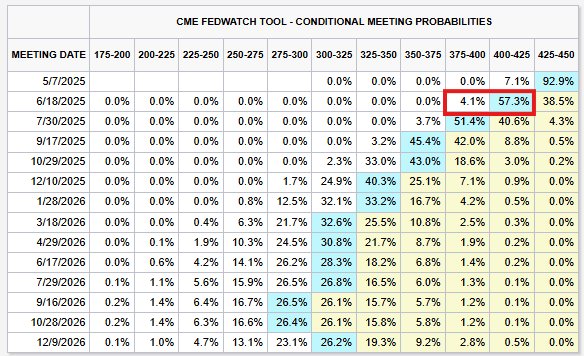

Following this morning's data, odds of rate cuts beginning in June 2024 are up to 61%. The fact that markets do not see IMMEDIATE cuts is more evidence of stagflation. The market does not know which part of the Fed's dual mandate will be sided with. Uncertainty is rising.

And, consumers are clearly feeling the effects of this situation. Consumer confidence plunged 8 points, to 86 in April, the weakest print since May 2020. This also marked the 5th consecutive monthly decline. Consumer confidence is falling off of a cliff amid uncertainty.

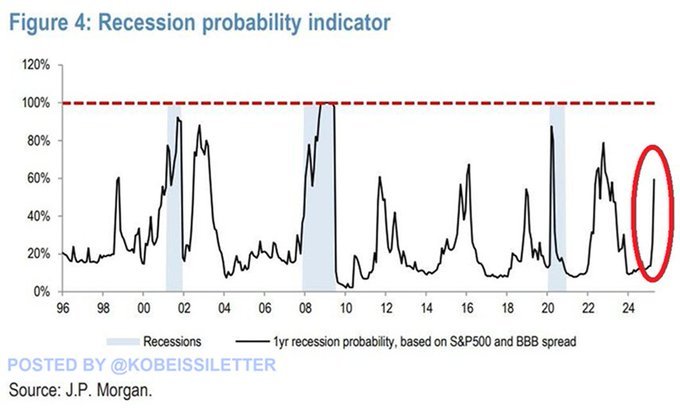

A recession in the US has become our base case scenario. 1-year recession odds priced by the S&P 500 earnings yield and the BBB-rated corporate bond spread are surging. An economic slowdown is here. Follow us @KobeissiLetter for real time analysis as this develops.