Iran's response has begun: After US strikes on Iranian nuclear facilities, Iran just attacked US military bases in Qatar and Iraq. Meanwhile, oil prices just CRASHED over -6% on the news. Why? Markets are saying EVERYTHING you need to know. Let us explain. (a thread)

Iranian media just announced that Iran has launched operation "Annunciation of Victory." Iran's Armed Forces said they will not leave any attack on Iran unanswered. This was Iran's first response to the US since the 3 strikes conducted by the US Airforce this weekend.

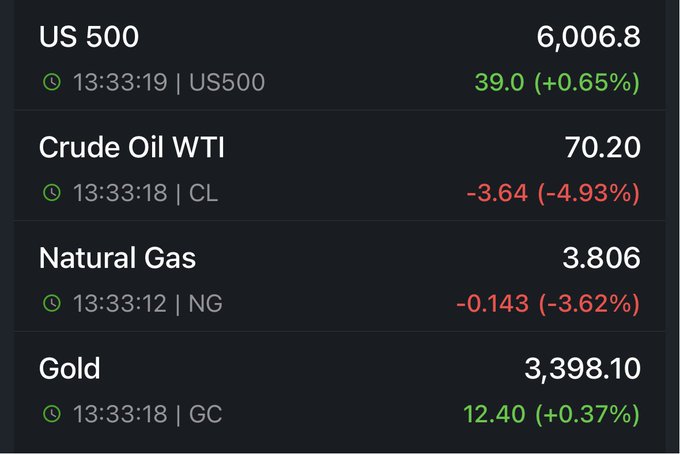

The initial reaction by markets was a selloff in stocks and a jump in oil prices. The most common thought process here is than an Iranian response is escalatory. But, this did NOT last long. In fact, the market is painting the EXACT OPPOSITE situation right now.

Take a look at the S&P 500. At 12:10 PM ET, the index began its decline, falling nearly -45 points on the news. Since then, just one hour later, the market has recovered all of its losses. In fact, stocks are on track to close the daily in the GREEN despite all of the chaos.

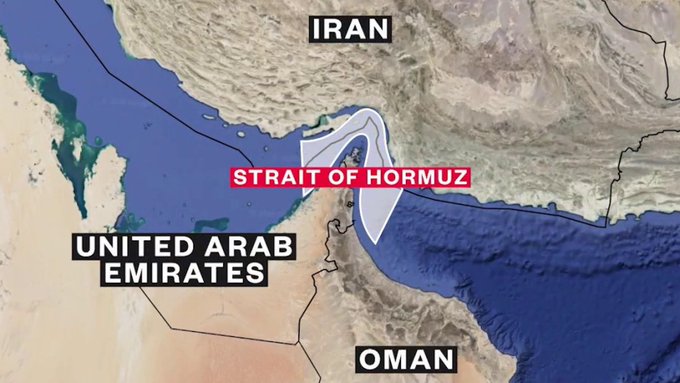

Furthermore, oil prices are getting crushed, nearing the key $70/barrel level. Even as Iran threatens to close the Strait of Hormuz, the US bombs Iran, and Iran bombs US bases, oil prices are down. The market has been painting a consistent picture: This is NOT World War 3.

On Sunday, we posted the below note on our "bull case" about this situation. This is one where Israel, Iran, and the US ALL claim victory. Today, that exact scenario is coming to fruition, with Iran now saying they dealt "devastating" blows to the US. https://x.com/KobeissiLetter/s...

Here's where it gets even more interesting: The NYT reports that Iran COORDINATED the attacks on US bases with Qatari officials. This was to "minimize casualties" according to Iranian officials. Again, this is a way for ALL parties to appear "strong" in a de-escalatory way.

On Friday, we posted the below alert for our premium members. We took SHORTS in oil at $74.10 and called for a "sell the news" event. These shorts are now DEEP green as oil prices fall into $70.00. Subscribe to access our alerts below: http://thekobeissiletter.com/s...

As we have been writing since the start of this war, markets have been clear: The market sees a SHORT-LIVED conflict and dips are being bought. If WW3 was truly likely, oil prices would be at $130+ and the S&P 500 would be down -30% or more. The exact opposite is the case.

Furthermore, even as Iran's Parliament voted to close the Strait of Hormuz, this is seeming unlikely. We believe Iran's top security body will NOT approve the closure. This was more of a symbolic move, and we see a higher chance of the US de-escalating after today's events.

Volatility has been the common denominator of 2025, but it's great for investors. The technicals remain strong and we continue to trade the swings in both directions. Subscribe to access our premium analysis and alerts at the link below: http://thekobeissiletter.com/s...

Overall, this is nowhere near a market pricing-in a prolonged conflict between global powers. Iran has responded in a calculated and de-escalatory way, in our view. Ignore the noise and follow the markets. Follow us @KobeissiLetter for real time analysis as this develops.